UKRI’s funding reforms are being presented as a move towards clearer priorities, stronger accountability and a more visible economic return from public research investment. UK Research and Innovation has set out how it will deploy its four-year £38.6 billion allocation, including £8 billion for targeted R&D linked to national and societal priorities, £7 billion for innovative company growth, £14 billion for curiosity-driven research, and further investment in skills and infrastructure. [1]

For the UK’s broader innovation economy, that matters well beyond the university sector. The way this funding is structured will shape what kinds of projects move forward, how research is translated into commercial value, and how resilient the UK’s research base remains across sectors such as life sciences, biotech, drug manufacturing, advanced manufacturing and advanced engineering. [1][5]

The stated logic behind the reforms is straightforward. In evidence to MPs, UKRI chief executive Sir Ian Chapman argued that the new bucket model should create a clearer line from mission to spend, reduce duplication across councils and make accountability more visible. He also said the previous model, which was organised more by discipline than output, made it difficult to see a coherent programme in areas such as life sciences or other strategically important sectors. [5]

That ambition is understandable. Public funders are under pressure to show how research spending supports growth, industrial strategy and real-world outcomes. But the central issue is not whether priorities should be clearer. It is whether the transition is being handled in a way that protects the university base on which much of that future value depends. [2][5]

The strongest public criticism so far has come from the BMJ, which argues that UKRI has not been fully transparent about how the projected allocations across the three buckets were calculated and that the detailed mechanisms under those buckets have yet to be established. According to the article, that lack of clarity has already made it harder for universities to plan around the changes. [2]

The same critique argues that researchers have been insufficiently engaged in shaping the reforms and warns that universities risk being treated as delivery agents rather than as valued collaborators. That matters because universities are not simply implementation bodies. They are where much of the UK’s discovery research, interdisciplinary capability, talent formation and early-stage innovation originate. [2]

UKRI has acknowledged the anxiety. In his February update, Chapman said the organisation had been moving too quickly, committed to wider consultation on implementation, and stated that applicant-led research would remain protected overall. He also said the UKRI applicant-led budget would rise from £815 million in 2026 to 2027 to £866 million in 2029 to 2030, while a quarterly forward-looking planner would be introduced to improve visibility over future opportunities. [3]

Those reassurances are important, but they do not remove the operational problem created by uncertainty. Chapman also confirmed that some funding routes had been temporarily paused, including changes affecting BBSRC, MRC and EPSRC, with the EPSRC Prosperity Partnership opportunity paused briefly so cross-UKRI input could widen its scope to other industrial strategy areas. For research-intensive institutions and sectors that rely on long planning cycles, even temporary disruption can have material effects. [3]

This is why the wider financial position of universities matters so much. Universities UK estimates that government policy decisions will lead to an overall £3.7 billion reduction in funding to higher education providers in England between 2024 to 2025 and 2029 to 2030. Its analysis also points to growing cost and income pressures linked to immigration policy, pension and National Insurance changes, levies on international fees, and changes to teaching and research funding. [4]

That context changes how UKRI’s reforms land in practice. A funding transition that might look manageable from the centre can be much more destabilising for institutions already dealing with tighter margins, rising costs and pressure on workforce planning. If that weakens the university research base, the downstream effects are likely to be felt across the commercial sectors that depend on it. [2][4]

Advanced engineering needs to be explicit in this discussion, not treated as a background subset of manufacturing. In committee evidence, Chapman said that for each industrial strategy sector funded separately there will be a dedicated programme board, with a clearer front door across UKRI. Using quantum as an example, he said the front door would sit with the executive chair of EPSRC, supported by teams from across UKRI including STFC, Innovate UK and Research England. [5]

That signals a more integrated route between university research, translational support, knowledge exchange and industrial application. Chapman also made clear that support for companies under bucket 3 is not limited to Innovate UK, but also includes Higher Education Innovation Funding and wider commercialisation and translation schemes. For advanced engineering businesses, that suggests the reforms could eventually produce a more coherent path from research capability to scale-up and adoption. [5]

The same logic applies to life sciences and biotech. These sectors rely on long-horizon research, specialist facilities, translational capability and highly skilled people. If the reforms improve coordination without undermining the institutions that generate the science, they could strengthen the route from discovery to industrial value. If not, they risk weakening the upstream capability that later-stage innovation depends on. [1][2][5]

That is particularly relevant for drug manufacturing and other research-intensive industries where commercial progress depends on the health of the wider ecosystem, not just on late-stage business support. Discovery science, collaboration, infrastructure and institutional stability all matter. A funding model that prioritises impact while destabilising the system that produces it would cut against its own stated objectives. [1][2]

There is also a question of consistency. UKRI’s own stakeholder engagement guidance says effective engagement is not just about telling people about research, but about creating channels for reciprocal dialogue and mechanisms that allow that dialogue to effect meaningful change. The same guidance says early and continued engagement with business and industrial partners can help address commercialisation challenges and support successful translation. [6]

NIHR guidance takes a similar line. It says applicants should show how relevant people and communities will shape different stages of the research lifecycle, how this work will be managed and resourced, and how its impact will be evaluated and shared. That makes the criticism of UKRI’s reform process more pointed. If funders expect partnership working and early engagement from applicants, there is a strong case that major funding reforms should reflect the same standard. [2][6][7]

For businesses in life sciences, biotech, drug manufacturing, advanced manufacturing and advanced engineering, the practical question is not whether UKRI’s funding reforms sound strategically rational in the abstract. In broad terms, they do. The more important question is whether UKRI can combine clearer priorities with a stable university base, credible engagement and a predictable funding pipeline. [1][2][3]

That point becomes even sharper when set against the UK’s wider talent ambitions. The government’s Global Talent Taskforce and £54 million Global Talent Fund are explicitly designed to attract world-class researchers and top-tier managerial and engineering talent into sectors tied to the industrial strategy, with UK universities positioned as part of that offer. If the UK wants to strengthen its position in high-value sectors, funding clarity and institutional stability will need to match that ambition. [8]

The core test of UKRI’s funding reforms is not whether the new structure is easier to describe. It is whether the reforms create a stronger link between research excellence, industrial application and long-term economic value without damaging the university system that underpins all three. That is why universities and researchers need to be treated as strategic collaborators in the reform process, not as an afterthought. [2][5]

For FI Group by EPSA’s audience, that is the real business issue. If the reforms are implemented with transparency, engagement and stability, they could help create a stronger pipeline from research to commercial growth. If they are not, the UK risks weakening the very research base that sectors such as life sciences and advanced engineering depend on. [1][2][4][5]

[6] UK Research and Innovation, Stakeholder engagement, updated 24 February 2026.

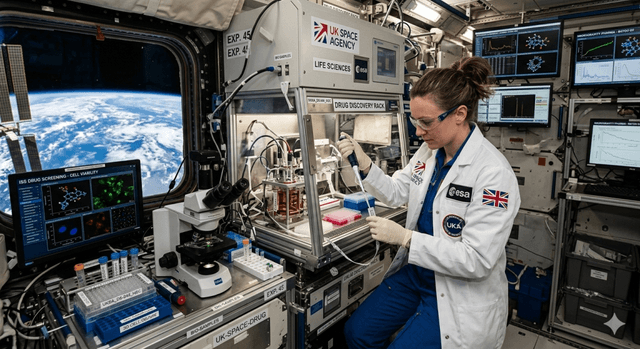

The UK government’s latest announcement on drugs manufactured in space matters because it starts to turn an emerging scientific concept into a more credible commercial pathway. On 5 March 2026, the UK Space Agency, MHRA, the Regulatory Innovation Office and the Civil Aviation Authority set out a coordinated package intended to help medicines developed in microgravity move from orbital research towards patient use on Earth. For UK pharmaceutical manufacturers and life sciences businesses, the significance is not simply scientific. It is regulatory, commercial and strategic. A clearer route to market makes it easier to assess whether space-enabled manufacturing is becoming a realistic part of future R&D and manufacturing portfolios. [1][2]

The government’s case rests on the unique conditions of microgravity. According to the official announcement, microgravity can improve how biologic drugs form, behave and work within the human body, with potential benefits for the quality, stability and performance of complex medicines. The same material links this to conditions such as cancer and rare diseases, which suggests the strongest near-term business case is likely to be in specialised, high-value therapies rather than commodity medicines. [1][2]

What has changed is not that the UK has created a separate medicines regime for space. It is that regulators are now spelling out more clearly how existing medicines regulation and spaceflight licensing can work together. The joint package includes regulatory guidance, principles-based case studies, a Re-entry Regulatory Sandbox and stronger supply-chain engagement, all designed to reduce uncertainty for businesses exploring in-orbit pharmaceutical activity. [1][2]

For life sciences companies, regulatory ambiguity has been one of the biggest obstacles to taking space manufacturing seriously. If a medicine is manufactured in orbit and then returned to Earth for patient use, businesses need confidence that the product can satisfy medicines regulation and that the mission itself can be licensed as a lawful spaceflight activity. The government’s latest intervention does not remove that complexity, but it does make the route more intelligible. [1][2]

The MHRA has indicated that existing medicines regulation can already support advanced and novel manufacturing approaches, including manufacturing that may take place in microgravity. In parallel, the UK’s spaceflight framework is described as flexible and outcome-focused, with the Civil Aviation Authority able to license novel in-orbit manufacturing missions under the current legislative structure. For businesses, that is significant because it suggests the UK is trying to adapt existing regulatory architecture to a new industrial environment rather than forcing companies to wait for an entirely new rulebook. [2]

This matters from a boardroom perspective because regulated sectors rarely invest seriously where legal and operational routes remain undefined. A clearer pathway does not make space manufacturing low risk, but it does reduce one of the major reasons for dismissing it as speculative. For UK businesses assessing long-term innovation bets, that is a meaningful shift. [1][2]

For pharmaceutical manufacturers, the practical question is not whether making drugs in space sounds futuristic. It is whether microgravity can deliver a measurable and defensible improvement in formulation, crystallisation, stability or delivery that could justify the cost and complexity involved. The strongest candidates are likely to be high-value medicines where even modest improvements in quality or manufacturability can create substantial clinical and commercial value. [1][2][4]

For biotech and life sciences firms, the announcement also changes the strategic conversation. It gives R&D leaders, regulatory teams and investors a better basis for asking which pipeline assets might genuinely benefit from microgravity, whether those benefits could be protected commercially, and how early regulatory engagement should be built into programme design. In effect, the UK is trying to shift space-enabled pharmaceuticals from the edge of the innovation agenda towards mainstream strategic evaluation. [1][2]

The announcement also sits within a broader UK growth narrative. The Life Sciences Sector Plan says the sector will be supported over the lifetime of the Spending Review by government funding of over £2 billion, alongside UKRI and NIHR funding. It also states that pharmaceutical R&D accounted for 17% of all UK business R&D in 2023, and sets the ambition for the UK to become the leading life sciences economy in Europe by 2030 and the third most important globally by 2035. In that context, a clearer pathway for space-manufactured drugs is not an isolated policy curiosity. It fits into a broader attempt to strengthen the UK’s position in high-value R&D, commercialisation and manufacturing. [2][3]

The government’s package points to a wider value chain than pharmaceutical companies alone. Supply-chain engagement, case-study development, regulatory sandbox work and efforts to support licensing for in-orbit manufacturing platforms all indicate that the opportunity extends to specialist manufacturers, payload developers, space platform providers, logistics businesses, regulatory advisers and investors in enabling infrastructure. [1][2]

BioOrbit is currently the clearest example of how the UK wants this ecosystem to develop. The UK Space Agency has backed the company with a £250,000 feasibility study. Official material says the PHARM study is intended to design an end-to-end mission to manufacture drugs in microgravity, and that collaborative work with MHRA is helping clarify the regulatory pathway for in-orbit pharmaceutical manufacturing. That matters because it shows the policy is being tested against a live commercial use case rather than remaining purely theoretical. [1][2][4]

Companies should still read the announcement carefully. The UK has set out a clearer path, not a frictionless one. Businesses will still need to prove product quality, reproducibility, safety, manufacturing control, chain of custody, re-entry planning and commercial viability. The continuing emphasis on guidance, case studies and sandbox activity shows that this remains an emerging market rather than a settled operating model. [1][2]

For UK pharmaceutical manufacturers and life sciences businesses, the most useful next step is disciplined assessment. Which products in the pipeline might benefit materially from microgravity? Where could regulatory design become a bottleneck? What evidence would be needed to support reimbursement and market access if a medicine were partly manufactured in orbit? Businesses that can answer those questions early will be better placed than those treating space manufacturing as a branding exercise rather than a commercial and regulatory challenge. [1][2]

From a UK business perspective, the real significance of this announcement is that it lowers the cost of taking the opportunity seriously. It does not guarantee that drugs manufactured in space will become a mainstream category. It does, however, provide a more coherent framework for linking scientific research, mission licensing, regulatory planning and eventual patient access. For companies that want to lead in advanced biomanufacturing rather than follow later, that may prove to be the most important shift of all. [1][2][3]

Sources

[2] UK Government, Joint Statement from the UK Space Agency, the Medicines and Healthcare products Regulatory Agency, the Regulatory Innovation Office and the Civil Aviation Authority, GOV.UK, published 5 March 2026.

[3] UK Government, Life Sciences Sector Plan, GOV.UK, published 16 July 2025.

The UK government has put high growth companies back at the centre of its industrial strategy, with a Budget that combines a £7 billion boost for innovation funding with the largest overhaul of entrepreneur tax incentives in a generation.

For Chief Financial Officers and Heads of Tax in scaling businesses, this is not simply another political announcement. It reshapes the mix of equity, debt and non dilutive funding available in the UK, and it arrives at a time when R&D tax relief is under greater scrutiny and SME claims are falling.

The Chancellor’s new package is built around three core pillars.

The government is:

EMI has not been updated for around 15 years. Extending the lifetime of options and raising the employee cap is designed to let companies keep offering meaningful equity deeper into their growth journey, rather than hitting a hard stop as headcount passes traditional thresholds.

A £7 billion injection into UK Research & Innovation (UKRI)

A substantial new commitment to UKRI will channel long term funding into science and technology, with an explicit focus on pushing breakthroughs from lab to market and keeping promising firms in the UK rather than losing them overseas at Series B or C.

Two specific initiatives stand out:

Innovate UK Growth Catalyst: a new £130 million programme that combines grants with hands on support for cutting edge science and tech firms. A previous iteration of this model turned £156 million of grants into £1.55 billion of follow on investment, a tenfold multiplier.

British Business Bank capital: the British Business Bank will invest £5 billion into growing companies, with the explicit goal of crowding in private capital and helping firms through the “valley of death” between R&D and commercial scale.

Alongside this, the government has committed to cut the administrative cost of regulation by 25 percent across the Parliament, which it estimates will save businesses around £6 billion a year, and has appointed Alex Depledge MBE as Entrepreneurship Adviser until 2026 to lead policy work on barriers to scale up growth.

HMRC’s latest statistics show that total R&D tax relief support fell slightly to £7.6 billion in 2023 to 2024, with the number of claims down 26 percent year on year and SME claims down by around 31 percent.

At the same time, claims are becoming larger on average, reflecting a pivot towards more intensive, higher value R&D and a smaller universe of claimants able to navigate the tightened rules and additional information requirements. For CFOs, that means:

Into this environment, the “scale up surge” is effectively a counterweight. It strengthens the growth stage parts of the system (UKRI programmes, Innovate UK, the British Business Bank, equity incentives) precisely as the pure tax based support for smaller claims becomes more demanding.

From a finance leader’s perspective, the announcement cuts across several persistent pain points:

The strategic takeaway is that the UK funding environment is becoming more barbelled. There is tougher scrutiny at the small claim, lower value end, combined with more firepower at the high growth, strategically important end. Finance leaders need to decide which side of that barbell their business will occupy over the next three to five years.

FI Group has observed this shift first hand in its work with high growth clients across technology, life sciences, manufacturing and energy. Many CFOs are now asking a different set of questions:

FI Group’s consultants are seeing particular interest in integrated innovation funding strategies that map a three to five year plan to specific instruments, rather than treating each grant or R&D claim as a one off transaction. That includes stress testing scenarios where R&D tax relief continues to tighten, while Growth Catalyst and UKRI competitions become more central to the funding mix.

From a third party perspective, FI Group’s role is to help companies translate macro level policy into concrete funding decisions. The consultancy supports CFOs by identifying eligible projects, modelling cash flow impacts, coordinating bids across multiple programmes and ensuring that R&D tax claims and grant funded workstreams are aligned rather than operating in silos.

For finance leaders in scaling businesses, a structured response might look like this:

Map your growth projects to the new funding landscape

Review equity incentive strategy under the new EMI and EIS rules

Re benchmark your R&D tax position

Engage early with British Business Bank and specialist lenders

Build an internal “innovation finance” capability

FI Group is an international innovation funding consultancy that works with more than 15,000 clients worldwide, helping them secure R&D tax relief, national and European grants, and innovation loans each year. Drawing on this experience, FI Group helps UK scale ups to:

By treating the new “scale up surge” as one part of a wider funding ecosystem, FI Group enables CFOs and finance teams to convert policy announcements into extended runway, stronger balance sheets and faster routes to market, without undermining long term shareholder value.

A new £14 million UK Germany quantum funding initiative will back joint R&D, photonics and shared standards. For quantum start ups and corporates, this signals fresh bilateral grant opportunities and a need to align R&D tax relief, grant funding and private capital.

The UK and Germany have announced a £14 million package to deepen collaboration in quantum technologies, unveiled during German President Frank Walter Steinmeier’s State Visit to the UK in December 2025.

The announcement has three pillars:

Government analysis suggests quantum could contribute around £11 billion to UK GDP and over 100,000 jobs by 2045, reflecting the scale of the opportunity in quantum computing, sensing and navigation systems.

In short, this initiative is not just symbolic diplomacy. It is a targeted intervention to knit together two of Europe’s strongest quantum ecosystems around joint funding, standards and applied industrial research.

Detailed call guidance has not yet been published, but the press release confirms that a £6 million bilateral quantum R&D call will open in early 2026, with matched contributions from Innovate UK and VDI Germany.

Based on previous UK bilateral programmes, quantum innovators should expect several common design features:

Alongside the call, the £8 million for Fraunhofer’s Glasgow centre is designed to accelerate commercialisation by supporting applied photonics research that underpins many quantum systems, as well as providing UK firms with a high quality industrial R&D partner.

The NPL PTB agreement on quantum standards will help ensure that devices and protocols developed under this initiative are aligned with emerging international metrology frameworks, lowering future interoperability risk for manufacturers.

This announcement sits within a wider UK Germany Strategic Science and Technology Partnership, launched in 2024 under the Kensington Treaty to deepen collaboration in areas including quantum, AI and clean tech.

For quantum specifically:

On the macro side, FI Group’s recent analysis shows that UK R&D spending has fallen by £2.8 billion in real terms since 2021, raising questions about how the UK will sustain its growth ambitions. HMRC’s latest statistics confirm that the number of R&D tax credit claims dropped by 26 per cent in 2023 to 2024, with SME claims down 31 per cent and total support estimated at £7.6 billion.

In that context, this UK Germany quantum funding initiative is significant for three reasons:

For quantum companies that sit at the intersection of capital intensive hardware and long time to revenue, those signals matter.

CFOs in quantum and advanced technologies face a particular set of pressures:

The UK Germany initiative touches all three.

Quantum and deep tech businesses should treat the UK Germany initiative as a catalyst to professionalise their funding strategy rather than as a one off opportunity.

FI Group works with quantum, photonics and advanced computing companies across the UK, Germany and the wider EU to:

In prior publications on UK R&D spending and quantum computing funding, we have highlighted the need to blend national and international grants with tax incentives to offset inflationary pressures and maintain innovation momentum. Companies seeking a deeper dive into UK competition mechanics can draw on funding advisers’ guidance on UK grant competitions and R&D tax services published on our website.

For leadership teams looking to respond pragmatically, a structured approach helps. Over the next 6 to 12 months:

Before final guidance is released, many innovators share similar questions. The answers below summarise what is known so far and how companies can position themselves.

Q1. When will the UK Germany quantum funding call open?

The government announcement states that a £6 million joint quantum R&D funding call from the UK and Germany will launch in early 2026, with Innovate UK and VDI Germany each contributing £3 million. Exact opening and closing dates will be set out in the formal competition briefing notes.

Q2. Who is likely to be eligible to apply?

While detailed eligibility is pending, prior bilateral calls suggest that consortia will include at least one UK and one German organisation. UK applicants are likely to include SMEs, large companies and research organisations eligible under Innovate UK rules, with German partners funded under VDI managed schemes. Academic only projects are unlikely to be prioritised over industry led collaborations.

Q3. Can companies combine this funding with R&D tax relief?

In principle, UK companies can still claim R&D tax relief on eligible expenditure, but the interaction between notified state aid and the merged scheme can be complex. Some costs supported by notifiable grants may need to be excluded or treated under the RDEC style mechanism. CFOs should model scenarios and seek specialist advice to avoid double counting or non compliant claims.

Q4. How does this initiative relate to other quantum grants in the UK and EU?

The bilateral call will sit alongside national instruments such as the UK National Quantum Technologies Programme and specific Innovate UK competitions, as well as European schemes including Horizon Europe and EuroHPC. Companies may be able to run sequential or complementary projects, but duplicating costs across programmes is prohibited.

Q5. What should CFOs and leadership teams do now?

The most productive actions now are partner scouting, project prioritisation and funding strategy design. That includes mapping where bilateral projects fit within your wider quantum roadmap, planning match funding and stress testing cash flow. Being ready with a credible, costed project concept when call details appear will be more valuable than reacting at the last minute.