With compliance checks up and rules tighter, R&D tax relief works best when the claim is built during the year, not after it. In-year claiming brings forward cash, lowers enquiry risk, and cuts the admin burden.

In-year claiming means compiling your R&D tax relief claim as you go, not filing the company tax return before the year end. You still file retrospectively once accounts are finalised. The difference is operational. You capture technical evidence and costs quarterly or biannually while projects are fresh, so the final claim is largely prepared already.

Three changes define today’s environment.

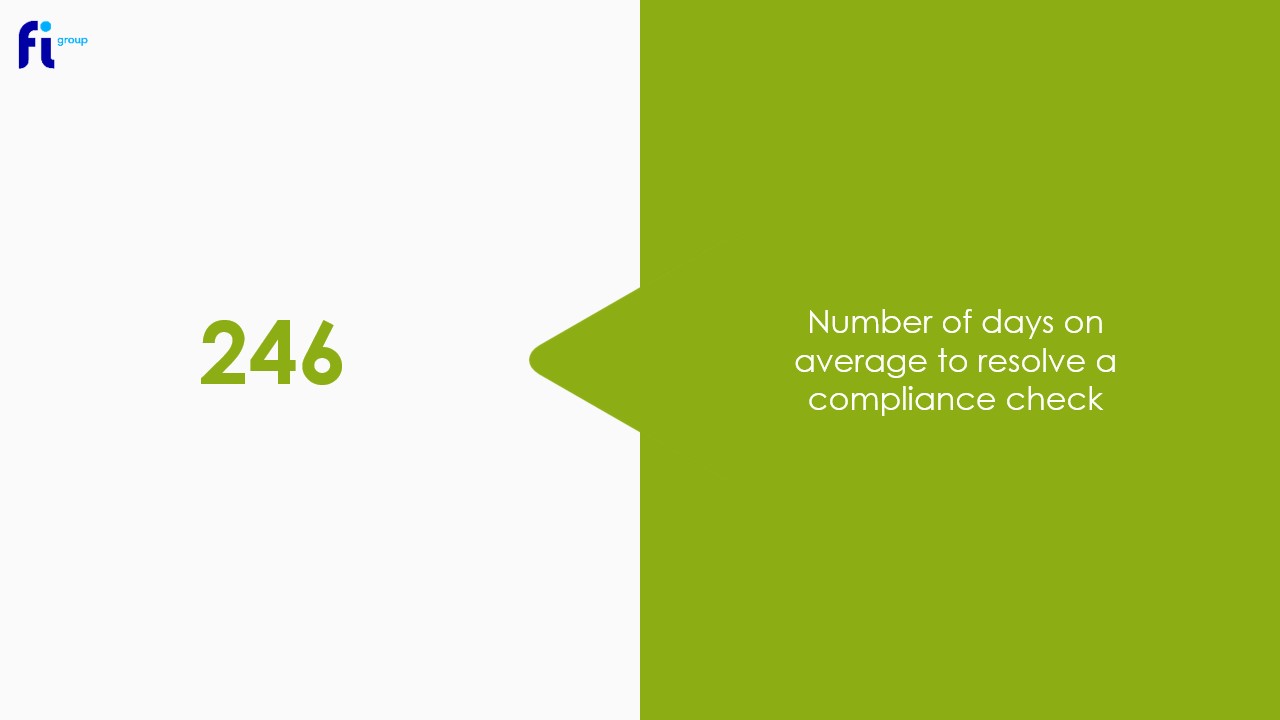

Alongside this, checks remain elevated. Around one in five claims face challenge, with enquiries taking close to eight months on average and more than three quarters reduced during review.

Most companies leave a minimum nine-month gap between spend and benefit because they assemble the claim after year end, then wait for accounts sign-off and processing. In-year claiming compresses that lag. By adopting in-year processes, businesses can often shift R&D tax relief from a 9–11 month wait into a 3 month benefit, depending on how quickly accounts are finalised and HMRC processes the return. You control two levers:

In-year practices directly address the common reasons for challenge, including poor technical evidence, malapportionment of software or consumables, and mis-treated EPWs or subcontractors. Enquiries now average more than 240 days and over three quarters of claims are reduced during checks, so building contemporaneous evidence is a practical risk reducer.

What is the effective benefit under the merged scheme?

The credit is 20% taxable and shown above the line. After 25% corporation tax the effective net benefit is roughly 15%.

Do overseas subcontractor costs still qualify?

From April 2024 most overseas costs are excluded, except in narrow circumstances such as unavoidable geography. Plan early.

What is ERIS and who qualifies?

ERIS supports loss-making SMEs that meet an R&D intensity threshold, which reduces to 30% from April 2024.

How long do enquiries take and how often are claims reduced?

Recent figures indicate enquiries average more than 240 days and over three quarters of claims are reduced during checks.

How does in-year claiming reduce risk?

It creates contemporaneous evidence, reconciled costs and an enquiry pack before filing, which shortens responses and raises confidence under scrutiny.

Merck has scrapped a planned £1bn UK expansion, will shift life sciences research to the US, and is cutting 125 UK roles, including an exit from London lab space near King’s Cross. For finance leaders, the signal is clear. UK projects face tighter ROI hurdles, so funding strategy, enquiry readiness, and cross-border optionality matter more than ever.

Merck will not proceed with the proposed £1bn UK expansion, will move a portion of life sciences research to the United States, and will close its London lab footprint with around 125 job losses. The company cited inadequate UK state investment and the undervaluation of innovative medicines, alongside more attractive conditions elsewhere.

Board debates on where to place R&D and scale-up work are becoming more pointed. The UK still has world-class science, but pricing pressures, adoption risk, and competition from the US and other regions heighten the bar for investment cases.

The decision reflects state investment gaps, pricing and adoption pressures, and stronger incentive ecosystems elsewhere. When future revenue visibility weakens, capital migrates to locations where reimbursement, uptake, and support combine to improve risk-adjusted returns.

Signals for UK-based portfolios:

“It is a great shame to see so much investment being pulled out of the UK life sciences market. A big reason behind this is that many smaller life sciences companies and research consortiums rely heavily on larger companies to facilitate partnerships and attract additional investment. This news only compounds that fact, and it may just be the start. In times like these, the finance edge comes from stacking non-dilutive funding and building audit-ready claims that travel well across jurisdictions.” – Dr. Giuseppe Amoroso, Senior R&D Tax Consultant, FI Group UK.

Expect tougher internal hurdle rates and more scrutiny of UK siting decisions. To preserve UK optionality, pair stacked non-dilutive funding with audit-ready claims and a cross-border incentive plan that the Board trusts.

Three finance realities now in play:

Stack funding, build an enquiry-ready evidence pack, and prepare cross-border options. Combine UK R&D tax relief with targeted grants, map every cost to the correct regime, and appoint one accountable partner to coordinate incentives across jurisdictions.

The UK remains competitive when R&D tax relief is paired with mission-fit grants and strong enquiry defence. CFOs should combine mechanisms and calibrate by project stage.

If your Board demands optionality, FI Group bridges strategy at HQ to execution in-country. We coordinate UK claims with US federal and state credits, European programmes, and LATAM/APAC incentives through one accountable lead.

What this looks like in practice:

Global Reach. Local Expertise. Your HQ sees the full picture. Your teams feel the local support.

| Objective | Primary lever | What good looks like | How FI Group de-risks it |

| Stabilise UK project ROI | R&D Tax Relief | Clear uncertainty narrative, systematic approach, reconciled costs | Technical interviews, dossier build, CT600 and AIF mapping, enquiry defence playbook |

| Accelerate milestones | Innovate UK or EU collaboration grants | Funding aligned to clinical and manufacturing milestones | Bid strategy, consortium formation, cost allocation and subsidy control checks |

| Maintain optionality | US, LATAM, APAC incentives | Pre-approved routes, timeline and cost comparisons | Single governance model with local experts and unified Board reporting |

| Reduce enquiry risk | Pre-submission QA | Independent review of narratives and calculations | Standard checklists, sampling, audit trail, version control |

| Improve forecastability | Master incentives calendar | One view of deadlines and rules by country | Central PMO, country playbooks, quarterly refresh cadence |

Is the UK now uninvestable for pharma?

No. The UK still offers outstanding science and talent. However, pricing, adoption and investment intensity vary. Your task is to stack incentives, shore up evidence, and keep cross-border options open so Board decisions do not stall.

Can we combine grants and R&D tax relief?

Often yes, with careful structuring. You must prevent double counting and respect subsidy rules. Map every cost by project and funding source, and align calculations to the correct regime for your accounting period.

What makes an R&D claim enquiry-ready in life sciences?

A tight technical narrative tied to technological uncertainty, an indexed evidence pack, named staff time linked to payroll, supplier evidence, and a clean reconciliation to your CT600 and Additional Information Form.

How does a one-team global model actually help Finance?

It reduces internal burden, centralises risk management, and ensures consistent quality across regions. That shortens cycles and improves audit outcomes while giving the Board a clear line of sight.

FI Group is a strategic advisory partner to CFOs, Heads of Tax, and Group Executives. We combine global reach with local expertise, delivering one governance framework across jurisdictions, with specialist authors and tax professionals in-country. Results include lower internal effort, higher claim quality, stronger audit defence, and accelerated rollout of funding across your portfolio.

Call to action: Talk to us about a stacked, cross-border funding plan that protects your UK pipeline while unlocking international support.

CFOs and founders increasingly recognise that growth cannot be fuelled by equity alone. The most successful scale-ups blend venture capital with non-dilutive funding, such as R&D tax relief, innovation grants, and government-backed loans. This strategy reduces dilution, extends runway, and validates technology in ways that strengthen investor confidence and speed market entry.

This guide sets out a CFO playbook for combining funding sources across the UK and Europe, with FI Group’s global-local delivery model ensuring compliance and consistency at every step.

A balanced innovation funding strategy deliberately mixes private equity with non-dilutive instruments. These include:

The goal is to make each pound of equity raised work harder, while reducing burn rate and aligning milestones with investor expectations. A balanced approach also provides external validation, as competitive grants and compliant R&D claims send strong quality signals to boards, auditors, and shareholders.

Every pound of grant or tax credit is a pound you do not need to raise in equity. This means more milestones can be reached without handing over additional equity, helping founders and early investors keep control.

Winning competitive grants or loans demonstrates external validation of your technical and commercial plans. Many schemes even co-invest alongside private equity, increasing round sizes and reducing investor risk.

Blended funding allows companies to progress on multiple fronts simultaneously; hiring, prototyping, regulatory approvals, all of which shortens time to market and strengthens exit potential.

Venture capital remains the largest pool of growth finance, with the UK consistently leading Europe and attracting nearly one-third of European deal volume. Despite market cooling since the record highs of 2021, deal sizes remain structurally larger than in the mid-2010s, with deep-tech and life sciences attracting outsized investor interest.

Since 2021, however, VC investment across Europe has declined year-on-year, reflecting global market corrections and greater investor caution. In contrast, government innovation funding has steadily increased, with the UK and France leading in absolute levels and Germany, Italy, and Spain expanding their support each year. This divergence highlights the stabilising role of public funding, enabling companies to sustain innovation momentum even as private markets tighten.

R&D tax relief is a significant driver of innovation. In 2022–23, HMRC reported around £7.5 billion of support across 65,000+ companies, confirming its material cash impact for innovative firms.

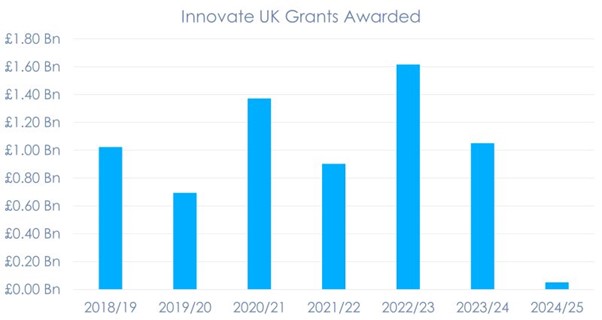

Innovation grants and loans fill critical funding gaps. Innovate UK alone deploys hundreds of millions annually through thematic competitions, with Innovation Loans offering up to £25 million per round for late-stage R&D where banks will not lend.

European programmes such as Horizon Europe and Eurostars provide collaborative cross-border funding, making international consortium-building a strategic tool for UK firms.

| Objective | Best-fit mechanism | How it helps | CFO watch-outs |

| Prove feasibility or early prototypes | Grants (Innovate UK, Horizon Europe) | Non-dilutive. External validation. Milestone discipline. | Competition intensity, reporting obligations, co-funding ratios |

| Reduce quarterly R&D burn | R&D tax relief | Offsets a portion of eligible costs. Improves P&L optics. | Eligibility definitions, documentation standards, enquiry risk |

| Bridge to commercial scale | Innovation loans | Patient debt for pre-revenue scale-up or pilot production | Repayment terms, competition deadlines, project viability tests |

| Accelerate growth and international roll-out | Venture capital | Provides scale, governance, networks, and follow-on capital | Dilution, milestone pressure, board oversight |

Innovation funding is not without risk. Common issues include:

The solution is to adopt a single-point global framework:

This structured approach saves CFOs time, improves board-level clarity, and avoids painful rework.

Managing incentives across multiple jurisdictions requires both global oversight and local compliance expertise.

FI Group operates a single point of contact model, supported by local engineers, tax specialists, and grant writers in the UK, EU, USA, South America, and Singapore. This ensures:

As we like to say: “Your HQ sees the full picture. Your teams feel the local support.”

FI Group’s consultants combine technical depth with fiscal expertise, meaning the same team that understands your codebase or laboratory work also knows the exact evidence HMRC, Innovate UK, or the European Commission expect.

Our approach:

“When we blend grants, R&D relief and equity at the right moments, clients maintain velocity without unnecessary dilution. The art is sequencing: validate with public funding, monetise costs through R&D relief, then raise equity against a stronger story.” – Dr. Fawzi Abou-Chahine, Funding Director, FI Group UK

Non-dilutive funding is capital that does not require giving up equity, such as grants, R&D tax relief, or innovation loans. It complements venture capital by reducing burn and extending runway.

Yes, many grant-funded projects can still claim R&D relief on self-funded eligible costs, provided claims are structured correctly with the right evidence.

Innovation Loans are long-term, low-interest loans offered by Innovate UK to support late-stage R&D and commercialisation. They typically allocate up to £25 million per round to innovative UK SMEs.

In 2022–23, HMRC reported around £7.5 billion of support through R&D tax relief, benefitting more than 65,000 companies.

No. In fact, public support usually de-risks rounds and validates the technical merit of your project.

No, but they act as a bridge for late-stage R&D where banks will not lend, reducing dilution before equity raises.

Inconsistent definitions and poor evidence trails. Without structured governance, claims are vulnerable to enquiry.

We manage technical interviews, documentation, and regulator questions so your teams can stay focused on delivery.

Turn complexity into clarity. Fast. Speak to FI Group about structuring a blended funding roadmap across the UK and Europe. We ensure your equity, grants, tax incentives, and loans are sequenced for maximum value.

Global reach. Local expertise. Your HQ sees the full picture. Your teams feel the local support.

Recent analysis has revealed that UK R&D spending has fallen by £2.8 billion in real terms since 2021, sparking concerns over the nation’s long-term growth ambitions. As the government continues to promote innovation-led recovery, this downward trend threatens to undermine competitiveness, productivity, and the ability of UK businesses to commercialise cutting-edge research.

Against this backdrop, advisory firms such as FI Group, specialists in R&D tax incentives and grant funding, are urging companies to act strategically to maintain momentum in innovation.

Globally, research and development is a recognised driver of productivity and competitiveness. According to OECD data, every £1 invested in R&D can generate multiple pounds in economic growth through knowledge transfer, commercialisation, and new business creation.

For the UK, where sectors such as life sciences, aerospace, energy, and digital technology underpin the industrial strategy, sustained investment is essential. Yet recent figures show businesses have scaled back spending in real terms, at a time when other countries, including Germany and the United States, are intensifying their R&D commitments.

Several factors are contributing to the contraction in UK R&D expenditure:

Without intervention, these challenges could limit the UK’s ability to meet its target of becoming a science and technology superpower by 2030.

Despite the decline, opportunities remain for firms willing to be proactive. Businesses can:

FI Group’s International Grants Guide 2025 highlights that public-private partnerships and European programmes remain accessible to UK firms, offering significant non-dilutive support for R&D investment.

According to Dr. Fawzi Abou-Chahine, Funding Director at FI Group UK, companies must take a strategic approach:

“Falling R&D spending is a wake-up call for businesses. By combining tax incentives with national and European grants, firms can offset inflationary pressures and maintain their innovation trajectories. The key is aligning projects with funder priorities and presenting compelling technical and commercial cases.”

With over 15,000 clients supported worldwide and £1.7bn in funding secured annually, FI Group provides both technical and financial expertise to help companies navigate complex R&D frameworks.

For UK businesses concerned about declining R&D budgets, immediate steps include:

Companies looking to safeguard their innovation strategies can explore FI Group’s dedicated services on R&D tax credits and UK grant competitions.

R&D tax relief is a valuable incentive for UK businesses investing in innovation, yet HMRC is becoming increasingly vigilant in reviewing claims. There have been changes in how HMRC challenges R&D tax credit claims and the number of compliance checks has risen sharply, with enquiries now averaging more than 240 days to resolve, and over three quarters of claims reduced during the process. Understanding the common HMRC enquiry reasons can help companies avoid costly delays, reduced claims, and reputational damage.

This article explores the top five HMRC red flags, why they arise, and how to safeguard your R&D claim defence with insights from FI Group’s specialist team.

HMRC requires clear, detailed evidence showing how your project meets the definition of R&D under the BEIS Guidelines. Missing or vague descriptions of technological or scientific uncertainty, methodology, and results often trigger an enquiry.

Common errors include claiming for non-qualifying activities, apportioning costs incorrectly, or including general overheads without justification. HMRC pays close attention to categories such as software licences, consumables, subcontractor costs, and staff time.

Many claims fail due to misunderstanding the rules on subcontracted R&D and EPWs. This is especially important when considering the different treatment under SME and RDEC schemes, and the restrictions on overseas contractors from April 2024.

HMRC often challenges claims where the activities are routine, commercially driven, or fail to address a genuine technological uncertainty. Projects that involve customisation or implementation without underlying technical advancement are particularly scrutinised.

A lack of contemporaneous records such as timesheets, invoices and project logs can undermine your position in an enquiry even if the R&D work took place. HMRC also expects evidence of strong governance over the claim process.

At FI Group, enquiry defence is a core part of our R&D tax credit service. For example, Ryan Haines, R&D Tax Manager, has successfully defended multiple HMRC enquiries, combining engineering expertise with claim compliance strategy. His approach integrates early risk assessment, thorough technical narratives and proactive liaison with HMRC, often resolving issues before they escalate.

FI Group’s experts combine sector-specific technical knowledge with a deep understanding of HMRC’s compliance focus. Whether you need a robust R&D claim defence or strategic advice to avoid enquiries altogether, we can help you protect and maximise your innovation funding.

Launching a tech-driven or R&D-focused business in the UK is no small feat. Between refining your product, attracting talent, and securing investment, founders are constantly juggling priorities. In this high-stakes environment, understanding how venture capital and R&D investment intersect is essential for maximising growth and minimising dilution.

Many startups naturally gravitate towards venture capital (VC) funding, which offers rapid access to capital, enabling businesses to scale through hiring or infrastructure development. Yet, an exclusive focus on VC can overlook the strategic benefits of combining it with R&D tax incentives and government-backed innovation schemes.

Venture capital plays a critical role in supporting startups from early-stage seed or angel investment through to later funding rounds such as Series A, B, and C. These funding stages provide growth runway but come with expectations. VCs demand consistent updates, evidence of progress, and clear reporting on how capital is being deployed.

For startups, this creates a time-sensitive environment where showing measurable returns on R&D investment becomes a key part of unlocking future capital. Venture capitalists are, after all, answerable to their own backers and need a compelling case for continued funding.

However, it is important not to view VC as the only route to financial sustainability. At FI Group, we support clients through a blend of R&D Tax Credits, grant funding, and innovation loans, each offering distinct advantages depending on a company’s size, stage, and sector. These funding streams can work in parallel, enhancing credibility with VCs while also preserving equity.

One of the greatest advantages of claiming R&D Tax Credits is the ability to raise non-dilutive funding. Unlike venture capital, R&D tax relief allows you to reinvest in your innovation without giving up shares or negotiating valuations.

While HMRC has introduced more scrutiny into R&D tax claims, resulting in post-claim compliance checks, this should not discourage innovative businesses. It simply underscores the value of working with a specialist like FI Group. Our consultants ensure claims are robust, compliant, and defensible, maximising your return while minimising risk.

For startups already engaging with venture capital, a successful R&D tax claim can act as a bridge between funding rounds. In periods of slow investor response or seasonal funding gaps, such as the expected VC application backlog this autumn, a timely claim can extend your runway and improve your negotiating position.

R&D Tax Credits do more than inject cash. They signal operational maturity. Companies that reinvest tax relief into hiring, product development, or IP generation not only accelerate growth but also increase their valuation in future VC rounds. This also enhances their eligibility for grant programmes, which can further support international expansion or commercialisation.

At FI Group, our grant consultancy includes innovation roadmapping, aligning your funding strategy with open grant calls and long-term IP development. This level of foresight builds investor confidence and can be integrated directly into pitch decks, showing a clear path to revenue and exit.

It is worth noting that venture capital investment and R&D tax claims do not always align by sector. In 2021, the most VC-backed UK sectors were Fintech, Health, and Energy. Meanwhile, HMRC’s highest R&D payouts went to Scientific & Technical Services, Manufacturing, and Information & Communications.

This disconnect is not necessarily negative. It reflects differing priorities. VCs chase high-return industries with scalable potential, while HMRC focuses on sectors driving national innovation. Both approaches are valid, but understanding their differences can help founders target the right funding source for their business model.

Whether you are seeking equity investment or leveraging government schemes, your industry focus will influence which doors open most readily.

The UK remains a top-tier destination for innovation thanks to a thriving venture capital ecosystem and a supportive R&D investment framework. While VC can accelerate growth, pairing it with strategic R&D funding offers a more sustainable and less dilutive path forward.

For startups and scaleups, aligning these two funding streams can not only improve cash flow but also enhance valuation, IP development, and investor trust. As VC and R&D landscapes continue to evolve, the smartest companies will be those that master both.

Clinical trial participants play a crucial role in the development of new medical treatments and therapies. This guide covers the key aspects of involving participants in clinical trials, including their definition, restrictions, and how to calculate R&D tax relief for their involvement.

Clinical trial participants are individuals who volunteer to take part in research studies aimed at evaluating new medical treatments, drugs, or therapies. These participants are essential for the advancement of medical science and the development of new healthcare solutions. Key criteria for clinical trial participants include:

Participants in clinical trials provide valuable data that helps researchers determine the safety and efficacy of new treatments. Their involvement is critical for the approval of new drugs and therapies by regulatory authorities.

From 1 April 2024, expenditure on overseas clinical trial participants does not qualify for R&D tax relief schemes. This change aims to encourage the use of local participants and resources.

This restriction can significantly impact companies that conduct international clinical trials. Businesses must adapt their strategies to comply with the new regulations, potentially increasing the demand for local participants.

When calculating R&D tax relief for clinical trials, companies must consider the following:

To accurately calculate R&D apportionments, companies should maintain comprehensive documentation, including participant agreements, trial protocols, and progress reports. This ensures that all eligible costs are captured and substantiated.

When making a claim for clinical trial participants, the following financial reports are required to analyse expenditure on a transactional level:

Accurate and thorough documentation is essential for successful R&D tax relief claims. Companies should ensure that all financial records are up-to-date and accurately reflect the costs associated with clinical trial participants.

Understanding the intricacies of involving Clinical Trial Participants is crucial for companies looking to maximise their R&D tax relief claims. By ensuring compliance with the latest regulations and accurately calculating qualifying expenditures, businesses can effectively manage their clinical trial costs.

For more detailed information on R&D tax relief and how to optimise your claims, visit the following resources:

R&D tax credits are a valuable incentive for companies investing in innovation. One of the key components are Consumable Costs in R&D Tax Credit Claims. Understanding what consumable costs can be included in R&D tax credit claims is crucial for maximising your benefit. This guide provides a comprehensive overview of eligible consumable costs, ensuring you make the most of your R&D tax credits.

Consumable costs refer to the expenditure incurred for items consumed or transformed in the R&D process. These items must be used in the R&D process and no longer usable in their original form. Examples include:

Similar to other cost categories, expenditure incurred for consumables must be apportioned relative to the extent it is used for qualifying R&D activities. Here are the methodologies for apportioning costs:

To calculate consumable costs for R&D tax credit claims, the following financial reports are typically required:

To further understand what consumable costs can be included in R&D tax credit claims, let’s delve into more specific details:

In many cases, consumables and utilities may be used for both R&D and non-R&D activities. Accurately apportioning these costs is crucial. Here are some strategies:

To understand more about the HMRC guidelines for what is included in consumable costs, click the button below.

Click here to return to all R&D qualifying costs.

R&D tax credits are a valuable incentive for companies investing in innovation. One of the key components of these claims is software licences. Understanding what software licences can be included in R&D tax credit claims is crucial for maximising your benefit. This guide provides a comprehensive overview of eligible software licences, ensuring you make the most of your R&D tax credits.

Software licences refer to the expenditure incurred for software, including cloud computing and data costs, which are directly employed in the R&D process. These can be categorised into:

Similar to staffing and subcontracted costs, expenditure incurred for software licences must be apportioned relative to the extent it is used for qualifying R&D activities. Here are the methodologies for apportioning costs:

To calculate software licence costs for R&D tax credit claims, the following financial reports are typically required:

To further understand what software licences can be included in R&D tax credit claims, let’s delve into more specific details:

In many cases, software may be used for both R&D and non-R&D activities. Accurately apportioning these costs is crucial. Here are some strategies:

Accurate record-keeping is essential for substantiating R&D tax credit claims. Companies should maintain detailed records of:

Claiming R&D tax credits for software licences can be complex, and companies often face challenges such as:

To see a full list of HMRC guidelines for software licenses visit here. Otherwise you can contact FI Group via the button below.

Contracted activities are a vital component of many research and development (R&D) projects. These activities are considered subcontracted when a company engages an external contractor to perform tasks that form part of a larger R&D project. Even if the subcontracted work isn’t R&D in isolation, it can still qualify as R&D expenditure for the company. For instance, a company might subcontract analytical testing to a specialised firm. While the testing itself may be routine, it qualifies as R&D because it supports a broader R&D project.

Expenditure on contracted activities qualifies under the SME scheme and, from 1 April 2024, the merged RDEC scheme. However, claims under the old RDEC scheme can only include contracted costs if they are subcontracted to a qualifying body (e.g., university, contract research organisation), an individual, or a partnership. Additionally, from 1 April 2024, expenditure on overseas contractors generally does not qualify, with some exceptions.

The relationship between the contractor and the claimant company affects the qualifying expenditure:

When subcontracted work is part of a larger R&D project, it doesn’t need to be R&D in isolation to qualify. The cost should be apportioned relative to the R&D project. For example, if a contractor performs validation testing solely for an R&D project, 100% of the cost can be claimed (subject to connected/unconnected restrictions). If the contractor’s work spans both R&D and non-R&D projects, the cost must be apportioned accordingly.

A contracted activity occurs when there is a formal agreement between a company and an external contractor to carry out specific tasks. These tasks, although not necessarily R&D in isolation, contribute to the overall R&D project. For example, a company might need specialised machinery for analytical testing, which it does not possess. By subcontracting this task to a firm that has the necessary equipment, the company ensures that the testing, although routine, supports its R&D efforts.

From 1 April 2024, the rules around qualifying expenditure for contracted activities will change. Under the SME scheme and the merged R&D scheme, expenditure on overseas contractors will generally not qualify, with some exceptions. This change aims to encourage companies to engage local contractors and support domestic R&D activities. Claims under the old RDEC scheme can only include contracted costs if they are subcontracted to a qualifying body, an individual, or a partnership.

The distinction between connected and unconnected contractors is crucial for determining qualifying expenditure. If the contractor is not connected to the claimant company, only 65% of the expenditure can be treated as qualifying. For instance, if a company pays £50,000 to an unconnected contractor, only £32,500 can be considered for the R&D calculation. Conversely, if the contractor is connected to the claimant company, the company can claim the lower of the qualifying payment for staff made to the staff provider or the actual cost incurred by the staff provider.

When subcontracted work forms part of a larger R&D project, it is essential to apportion the costs accurately. The cost should be relative to the R&D project it supports. For example, if a contractor is only performing validation testing for an R&D project, 100% of the cost can be claimed, subject to connected/unconnected restrictions. However, if the contractor’s work spans both R&D and non-R&D projects, the cost must be apportioned to reflect only the R&D-related activities.

At FI Group, we specialise in helping companies navigate the complexities of R&D tax relief claims. Our team of experts can assist you in identifying qualifying expenditures, ensuring accurate apportionments, and maximising your claims. We provide comprehensive support throughout the claim process, from initial assessment to submission, ensuring compliance with all relevant regulations. With our extensive experience and tailored approach, we help you unlock the full potential of your R&D investments.

Externally Provided Workers in R&D claims are seen as the temporary staff supplied by third-party agencies. This guide covers the key aspects of EPWs, including their definition, restrictions, and how to calculate R&D tax relief for their services.

EPWs are individuals who provide services to a company but are not its employees or directors. They are typically supplied by a staff provider, such as a temp agency. To qualify as an EPW, the individual must:

EPWs are distinct from regular employees and contractors due to their temporary nature and the involvement of a third-party provider. This arrangement allows companies to flexibly manage their workforce without the long-term commitments associated with direct employment.

From 1 April 2024, expenditure on overseas EPWs does not qualify for R&D tax relief schemes. This change aims to encourage the use of local talent and resources. Companies must ensure that their EPWs are based within the country to benefit from these tax reliefs.

This restriction can significantly impact companies that rely heavily on international talent. Businesses must adapt their hiring strategies to comply with the new regulations, potentially increasing the demand for local EPWs.

If the staff provider is not connected to the claimant company, only 65% of the expenditure paid to the staff provider can be treated as qualifying expenditure. For example, if £100,000 is paid to a staff provider, only £65,000 can be considered for the R&D calculation.

If the staff provider is connected to the claimant company, the company may claim the lower of the qualifying payment for staff made to the staff provider or the actual cost of the relevant staff incurred by the staff provider.

Understanding the difference between connected and unconnected providers is crucial for accurate R&D tax relief claims. Connected providers might include subsidiaries or companies with shared ownership, while unconnected providers operate independently.

EPWs are considered temporary staff. Therefore, the methodologies detailed in the Staffing Costs section of the R&D tax relief guide can be used to calculate R&D costs for EPWs. This includes apportioning costs based on the time spent on R&D activities.

To accurately calculate R&D apportionments, companies should maintain detailed records of EPW activities. This includes timesheets, project reports, and any other documentation that can substantiate the time and effort spent on R&D projects.

When making a claim, the following financial reports are required to analyse expenditure on a transactional level:

Accurate and thorough documentation is essential for successful R&D tax relief claims. Companies should ensure that all financial records are up-to-date and accurately reflect the costs associated with EPWs.

Understanding the intricacies of Externally Provided Workers in R&D claims is crucial for companies looking to maximise their R&D tax relief claims. By ensuring compliance with the latest regulations and accurately calculating qualifying expenditures, businesses can effectively manage their temporary staffing costs.

R and D tax credits are a valuable incentive for companies investing in innovation. One of the key components is working out staffing costs in R&D tax credit claims. Understanding what staffing costs can be included in R&D tax credit claims is crucial for maximising your benefit. This guide provides a comprehensive overview of eligible staffing costs, ensuring you make the most of your R&D tax credits.

Staffing costs refer to the expenses incurred for directors or employees who are directly and actively engaged in R&D activities. These costs can include:

It’s important to note that costs related to benefits-in-kind do not qualify for R&D tax credits.

Staffing costs can be categorised based on the type of activities employees are engaged in:

Direct Activities: These are activities that directly contribute to achieving the R&D advance, such as design, development, and testing.

Qualifying Indirect Activities: These activities support the R&D process but do not directly resolve scientific or technological uncertainties. Examples include:

When only a portion of an employee’s time is spent on R&D activities, it is necessary to apportion their staffing costs accordingly. This can be done using timesheets or other project tracking data. Here are some common methodologies:

For each eligible project, employees’ time should be assessed to determine the proportion of their work that qualifies as R&D. This can be done on a project-by-project basis or across multiple projects. The methodology may vary depending on whether timesheets are used:

Calculating costs for qualifying indirect activities can be more complex. These activities are often carried out by supporting functions such as finance, HR, and administration. Common methodologies include:

An employee is generally someone who has a contract of employment with the company. In group companies, employees may be shared across different entities, but this does not affect their status as employees for R&D tax credit purposes. Payroll operations managed by another company within the group do not change the employment status of the staff.

To calculate staffing costs for R&D tax credit claims, the following payroll-related items are typically required:

This information helps in accurately calculating the PAYE cap and ensuring compliance with HMRC guidelines.

To further understand what staffing costs can be included in R&D tax credit claims, let’s delve into more specific details:

In many cases, employees may have mixed roles, where they spend part of their time on R&D and part on other activities. Accurately apportioning their costs is crucial. Here are some strategies:

Accurate record-keeping is essential for substantiating R&D tax credit claims. Companies should maintain detailed records of:

Claiming R&D tax credits can be complex, and companies often face challenges such as:

R&D tax relief schemes are designed to encourage innovation by allowing businesses to claim back certain types of expenditure. Understanding what qualifies as R&D expenditure is crucial for maximising your claim. This and the subsequently linked guides outline the main categories of expenditure that can be claimed under the current R&D tax relief schemes in the UK.

Staffing costs are a significant component of R&D expenditure. These include:

For more detailed information on staffing costs, visit our dedicated staffing costs page here.

Externally provided workers are individuals supplied by an external agency to work on your R&D projects. The costs associated with EPWs can be claimed if:

Learn more about EPWs and their eligibility, visit our dedicated EPW page here.

When R&D activities are contracted out to third parties, the costs can be claimed under certain conditions:

For further details, refer to our contracted out R&D guidance.

Software licences used in R&D projects are eligible for tax relief. This includes:

For more information on claiming software costs, check out our software costs guidelines.

Consumables are items that are used up or transformed during the R&D process. These include:

Visit our consumables guidance for more details.

For companies involved in clinical trials, the costs associated with recruiting and compensating volunteers can be claimed. This includes:

For more information on clinical trial costs, see our clinical trial guidelines.

Before starting it is important to know what information is needed for a R&D tax claim and gathering specific financial documents is crucial to ensure a smooth and accurate process. This guide outlines the key information and reports required from clients to kick off a new claim, along with tips to streamline the process and additional resources for further reading.

To begin the financial analysis for an R&D tax claim, we request the following documents for the relevant claim period(s):

This report provides a comprehensive overview of the company’s revenues, costs, and expenses during a specific period. It helps in understanding the financial performance and profitability, which is essential for calculating eligible R&D expenditures.

The balance sheet offers a snapshot of the company’s financial position at a given point in time, detailing assets, liabilities, and equity. This information is vital for assessing the overall financial health and stability of the business.

This includes details of all financial transactions, such as invoice dates, accounts, descriptions, and costs. The general ledger is crucial for tracking all expenditures related to R&D activities, ensuring that all eligible costs are accounted for in the claim.

This report provides a breakdown of payroll expenses per employee per month, including gross pay, bonuses, employer-paid National Insurance, employee-paid NI, employee PAYE, and employer-paid pensions. Payroll costs are a significant component of R&D claims, and detailed payroll reports help in accurately calculating these expenses.

This report lists all outstanding payables, categorised by the length of time they have been due. It helps in understanding the company’s short-term liabilities and managing cash flow, which can impact the timing and amount of R&D tax credits.

The tax computation document details the company’s tax liability, which is used to calculate the benefit after the claim is finished. This document may not be available for in-year claims (real-time claims) as it is prepared after the fiscal year ends and the accounts are finalised.

To make the process as seamless as possible, we recommend the following steps:

Providing accurate and comprehensive financial information is essential for maximising your R&D tax claim. Here are some benefits of ensuring that all requested documents are complete and accurate:

Clients often face challenges when gathering the necessary information for an R&D tax claim. Here are some common challenges and solutions:

If you have any questions or need further assistance, please don’t hesitate to reach out to our team. We’re here to help you navigate the R&D tax claim process efficiently and effectively. For more information or personalised support, get in touch with us here. We look forward to assisting you!

As the UK Managing Director at FI Group, I recently encountered a prospect who was handling his R&D tax claims internally. To save time, he decided to use ChatGPT to write his report. On the surface, the output was impressive: a tailored report based on HMRC guidance with a detailed description of his technology. However, upon closer inspection, we identified several anomalies that could jeopardise the claim.

Firstly, the field of science or technology was not linked to a known field identifiable from the Frascati Manual. Throughout the report, the field of technology changed multiple times, which is a red flag for HMRC. Secondly, the baseline section did not reference other solutions and merely stated “no viable alternative,” a known bugbear for HMRC. Thirdly, the advance section incorrectly linked to DSIT paragraph 9a instead of 9b. Finally, the uncertainties section lacked the necessary information required by HMRC.

It would be tempting to trust ChatGPT, but our review revealed several technical problems with the claim. Another issue was the length of the descriptions. Each answer for the AIF was around 1000 words, which is too lengthy for HMRC, given their limited time to review claims.

The theory behind using AI to link technology to HMRC guidance is sound, but in practice, it falls short for several reasons. From a human perspective, the intellectual property of R&D tax consultants lies in knowing what HMRC expects and what information to use. Controlling the input with AI is crucial, and without detailed input, the output will never meet the required standards. R&D tax claims go into enquiry 17% of the time, causing an average of 246 days of cash flow delay and additional time from the business. The time saved using ChatGPT is negligible compared to the consequences.

Moreover, ChatGPT does not understand the tone HMRC prefers for these reports.

In summary, while AI tools like ChatGPT can assist in drafting reports, they cannot replace the expertise and nuanced understanding of human consultants. The risks of inaccuracies, inconsistencies, and non-compliance with HMRC guidelines are too high. Therefore, businesses should be cautious and ensure that any AI-generated content is thoroughly reviewed by professionals.

Innovation incentives, such as grants and R&D tax credits, play a crucial role in driving economic impact for the UK. In recent years, these have led to the creation of approximately 150,000 new jobs, particularly in highly skilled sectors like biotechnology, medical equipment, engineering, life sciences, and high-tech manufacturing. Sitting alongside these sources of non-dilutive funding is innovation debt, a key piece of the venture funding landscape that some businesses overlook. But how was the recent changes to the Budget impacted this funding landscape?

Grants stimulate significant economic growth, contributing £43 billion in turnover for UK companies. This growth comes from productivity increases, jobs growth, greater investor confidence as well as prestige. The return on investment is also substantial, with every £1 of grant funding generating a return of £7.50 to £8 for the UK economy. This highlights the importance of innovation incentives in fostering economic development and enhancing productivity.

However, this fiscal year has seen a 10x drop in grant funding compared to previous years across a similar period.

The yearly Innovate UK R&D grant investment should average ~£1.2bn, but from April 2024 to October 2024, only £50m has been awarded. It is unclear to what extent reductions to capital expenditure grant funding has been, but given the year-long delay of the £185m flagship decarbonisation fund IETF, it is likely only ~£150m of capital projects will be granted in 2024/25.

A likely reason for this absence of essential funding is the change in government, which may have only delayed funding, rather than abandoned it completely. Nevertheless, a 10x reduction in grants this financial year means competition for grants has increased greatly, so a specialist grant advisor is essential.

Despite numerous changes to the wider tax landscape, thankfully R&D tax credits have remained in place. These credits significantly boost investment in research and development, with every £1 spent on these credits leading to an additional £1.53 to £2.35 in R&D spending by UK companies. In the 2021-22 fiscal year, £7.6 billion in R&D tax relief supported £44.1 billion in R&D expenditure, driving economic growth through technological advancements. Companies that consistently invest in R&D are predicted to be 13% more productive, enhancing overall economic efficiency and competitiveness. However, changes to legislation in recent years has increased the scrutiny by HMRC and the reporting quality needed to claim funding. Working with a specialist consultant to justify the technical eligibility, not just the financial ones is essential to navigate the changing landscape. You can read more about the changes here.

Lending money to profit-making and revenue generating businesses is well established, but financing the high-R&D pre-revenue SME market is still a relatively new market. According to the British Business Bank, 43% of UK SMEs perform innovation and yet 26% of those SMEs are not-yet-profit-making. Generally, innovation loans are less expensive that venture capital and contribute to a more even way to finance a business as you do not have to give up equity. Innovate UK has started to offer loans to businesses and this trend will continue as it partners with professional debt lenders. FI Group partners with SPRK Capital, a market leader in UK venture lending, to offer businesses access to wider non-dilutive funding.

If you are wondering how to fund your business’s innovation, speak to FI Group, specialists in securing grants and R&D tax credits. Our technical and financial experts keep on top of the ever changing legislative landscape to maximise the funding you can secure, so you can grow your business. For more information on how to access innovation funding, or how the Budget may have impacted your business, speak to our team.

The UK government has introduced significant changes to the R&D tax relief rules, particularly affecting overseas R&D expenditure. These changes, effective from April 1, 2024, are part of the Finance Act 2024 and aim to encourage more R&D activities within the UK. The key aspects of these new rules include:

Restrictions on Overseas R&D Expenditure:

Qualifying R&D Activities

The definition of qualifying R&D activities remains focused on projects that seek to achieve an advance in science or technology. However, the location of these activities is now a critical factor. Companies must demonstrate that the R&D activities are conducted within the UK unless they fall under the specified exceptions.

Evidence Requirements

Companies must maintain detailed records to support claims for R&D tax relief, demonstrating where the R&D activities are conducted. This includes contracts, invoices, and other relevant documentation. The documentation should clearly outline the nature of the R&D activities, the location, and the necessity for any overseas work.

Transitional Provisions

There are transitional provisions for accounting periods beginning before April 1, 2024, allowing some flexibility as companies adjust to the new rules. During this transitional period, companies can continue to claim relief for overseas R&D expenditure under the old rules, provided the expenditure was incurred before the cut-off date.

Impact on Multinational Companies

Multinational companies with R&D operations spread across different countries will need to reassess their R&D strategies. The new rules may necessitate a shift of R&D activities to the UK or a restructuring of how R&D projects are managed and documented.

The Additional Information Form (AIF) is a crucial development in the R&D tax relief landscape, introduced by HMRC in August 2023. This mandatory form aims to enhance the transparency and accuracy of R&D tax relief claims, ensuring that only legitimate claims are processed. The introduction of the AIF marks a significant shift in how businesses document and submit their R&D activities, providing HMRC with detailed insights into the nature and scope of the projects being claimed.

The primary reason for introducing the AIF was to combat the rising levels of non-compliance and fraud associated with R&D tax relief claims. By requiring businesses to submit comprehensive details about their R&D projects, including the scientific or technological advancements sought and the uncertainties faced, HMRC can better assess the validity of each claim. This move not only protects the integrity of the R&D tax relief scheme but also ensures that taxpayer money is used effectively to support genuine innovation.

The AIF affects all businesses seeking to claim R&D tax relief, regardless of their size or industry. Both small and medium-sized enterprises (SMEs) and larger companies must now provide detailed project descriptions, cost breakdowns, and evidence of the R&D activities undertaken. This increased level of documentation can be challenging for some businesses, particularly those with limited resources or experience in preparing such detailed claims. However, it also brings about a more level playing field, ensuring that all claimants adhere to the same standards of transparency and accuracy.

Read about the changes to R&D in 2024

The Additional Information Form (AIF) must be submitted before or on the same day as your Company Tax Return (CT600). If you submit the tax return before the AIF, your R&D tax relief claim will be rejected. Therefore, it’s crucial to ensure the AIF is submitted first, followed by the tax return.

The Additional Information Form (AIF) must be submitted by any business seeking to claim R&D tax relief or the R&D Expenditure Credit (RDEC) for accounting periods beginning on or after April 1, 2023. This includes:

The AIF can be completed and submitted by a representative of the company or an agent, such as FI Group (R&D tax specialists), acting on behalf of the company.

| Category | Details |

| Company Information | – Unique Taxpayer Reference (UTR) – Employer PAYE reference number – VAT registration number – Standard Industrial Classification (SIC) code – For Northern Ireland companies: Company Registration Number (CRN) and registered business address |

| Contact Information | – Main senior internal R&D contact (e.g., company director) – Details of all agents involved in the R&D claim |

| Accounting Period | – Start and end dates of the accounting period, matching the Company Tax Return |

| R&D Intensity Details | – Total relevant costs – Connected companies’ relevant R&D and total costs – Qualifying R&D expenditure |

| Project Details | – Description of projects, depending on the number of projects claimed – For 1-3 projects: Describe each project – For 4-10 projects: Select projects accounting for at least half of the qualifying expenditure – For more than 10 projects: Select the top 10 projects with the highest qualifying expenditure |

For guidance on how to complete the Additional Information Form, a qualified R&D tax expert may be best placed to advise you on the process.

When completing the Additional Information Form (AIF) for R&D tax relief, it’s essential to provide detailed descriptions of each project. Here’s a guide to help you:

Provide a brief description of the field of science or technology related to the project. Use the following terminology:

Describe the existing level of knowledge or capability at the project’s start:

Describe the intended advance using the baseline level as a comparison. This could include:

Detail the uncertainties faced, such as:

Explain:

Describe the direct R&D activities and qualifying indirect activities used to resolve uncertainties:

When submitting the Additional Information Form (AIF) for R&D tax relief, businesses often encounter common errors that can lead to delays or rejections. Here are some of the most frequent mistakes:

For guidance on how to complete the Additional Information Form, a qualified R&D tax expert may be best placed to advise you on the process.

You may need to review your methodology and assess how robust your approach is in light of these new requirements and HMRC’s enhanced compliance activities. It’s important to consider this before starting to prepare your R&D claim to avoid additional work when submitting the claim. FI Group is well-positioned to assist, with a proven track record of preparing detailed project descriptions to support our clients’ claims. Our team can provide additional capacity for in-house teams adapting to the new requirements. Contact us to see how we can help.

HMRC Compliance Impact on R&D Tax Claimants

In the face of ongoing economic uncertainties in 2024, businesses are increasingly reliant on R&D tax credits to fuel innovation and maintain competitiveness. This white paper examines the latest HMRC compliance statistics and their implications for R&D tax claimants, emphasising the need to adopt an in-year approach as per HMRC’s guidance released on 31st October 2023.

Commentary: The significant increase in compliance workforce reflects HMRC’s intensified focus on scrutinising R&D tax claims. For claimants, this means a higher likelihood of facing compliance checks, necessitating meticulous documentation and adherence to guidelines. Adopting an in-year approach can help businesses stay aligned with HMRC’s expectations and reduce the risk of non-compliance.

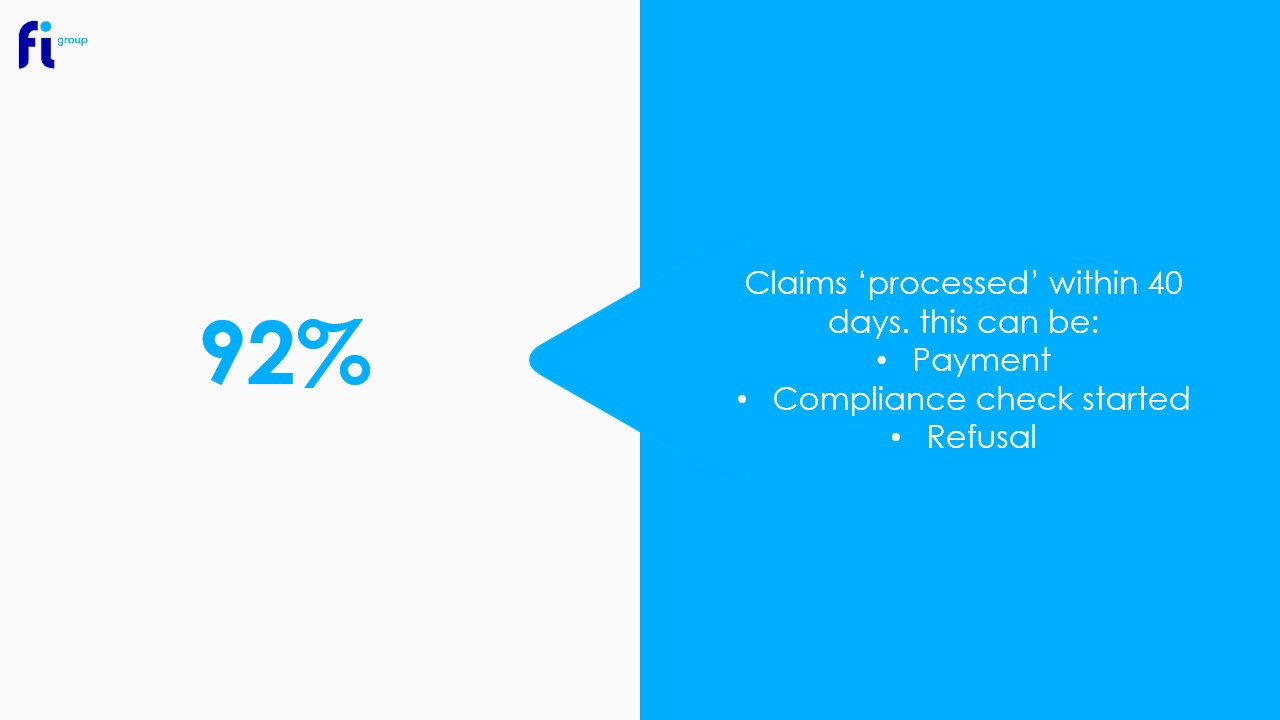

Commentary: While a high percentage of claims are processed within 40 days, the definition of ‘processed’ includes payment, compliance check initiation, or refusal. This ambiguity can create uncertainty for claimants. An in-year approach allows businesses to continuously monitor and update their claims, ensuring they are prepared for any compliance checks and reducing potential delays.

Commentary: Large companies must be particularly vigilant, as every claim undergoes deep scrutiny. This underscores the importance of robust internal processes and thorough record-keeping. By adopting an in-year approach, large companies can ensure ongoing compliance and be better prepared for HMRC’s scrutiny.

Commentary: The rise in compliance checks indicates a more stringent review process. Claimants should be prepared for increased scrutiny and ensure their claims are well-supported by detailed evidence of qualifying R&D activities. An in-year approach facilitates regular updates and reviews of R&D activities, making it easier to provide accurate and comprehensive documentation.

Commentary: The lengthy resolution time for compliance checks can pose cash flow challenges for businesses, particularly in a tight economic climate. Companies should plan for potential delays and consider the financial impact of prolonged compliance processes. An in-year approach helps mitigate these challenges by ensuring claims are continuously updated and ready for review, potentially speeding up the resolution process.

Commentary: A high proportion of claims are reduced during compliance checks, highlighting the critical need for accuracy and thoroughness in claim preparation. Businesses must ensure their claims are fully compliant to avoid reductions and potential financial setbacks. Adopting an in-year approach allows for regular verification and correction of claims, reducing the likelihood of reductions during compliance checks.

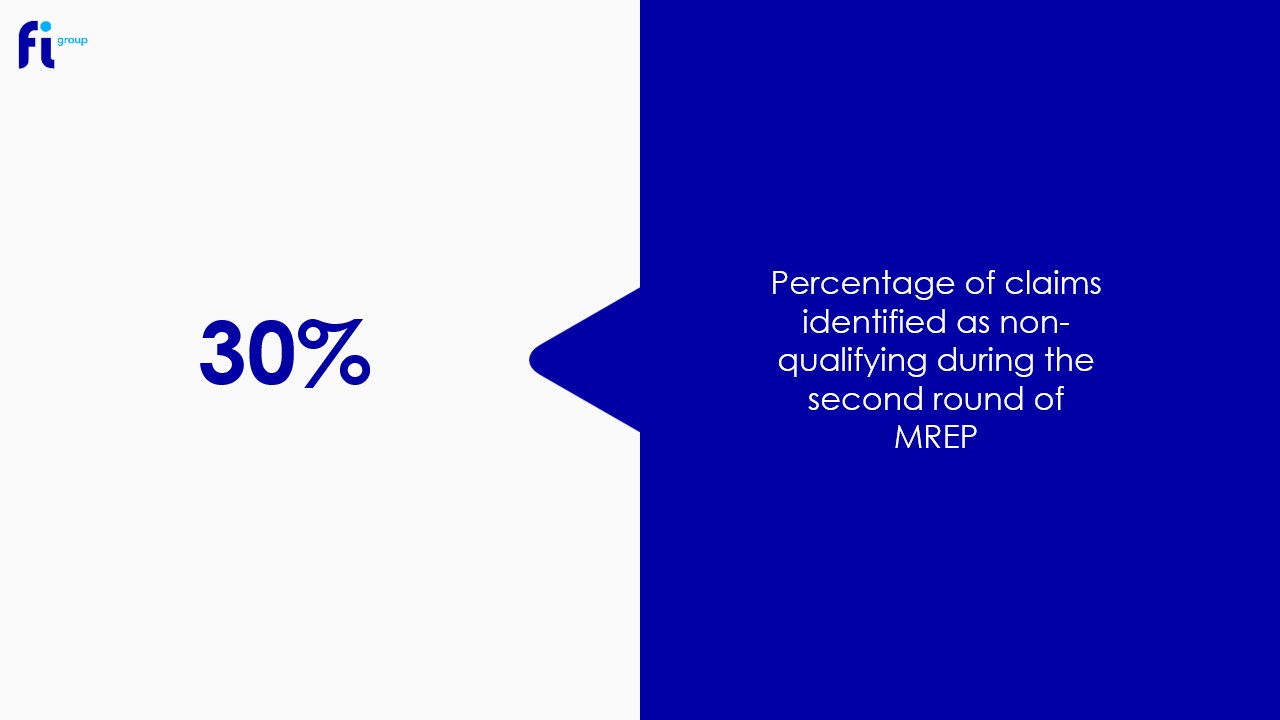

Commentary: The MREP process reveals significant issues with claim qualifications, with a notable percentage of claims being reduced or identified as non-qualifying. This stresses the importance of understanding and adhering to HMRC’s criteria for R&D tax credits. An in-year approach ensures continuous alignment with HMRC’s guidelines, reducing the risk of non-qualifying claims.

Commentary: While fraud remains relatively low, errors are a more significant concern. This suggests that many businesses may be inadvertently making mistakes in their claims. Enhanced training and guidance on claim preparation could help reduce error rates. An in-year approach promotes regular review and correction of claims, minimising errors and improving overall compliance.

Commentary: The high rate of HMRC decisions being upheld in ADR cases indicates that HMRC’s initial assessments are generally robust. Claimants should ensure their claims are well-founded and consider ADR as a last resort. An in-year approach helps businesses maintain accurate and compliant claims, reducing the need for ADR.

The economic challenges of 2024, including inflationary pressures, supply chain disruptions, and market volatility, amplify the importance of R&D tax credits for businesses. However, the increased scrutiny and compliance requirements from HMRC necessitate a strategic approach to claiming these credits. Adopting an in-year approach, as recommended by HMRC, allows businesses to stay compliant, reduce errors, and ensure timely processing of their claims.

Navigating the complexities of R&D tax credits in 2024 requires diligence and strategic planning. By adopting an in-year approach in line with HMRC’s guidance, businesses can maximise their R&D tax benefits and support their innovation efforts amidst economic challenges.

FI Group specialises in helping businesses navigate the complexities of R&D tax claims, ensuring compliance with HMRC regulations. Our expert team provides comprehensive support throughout the entire process, from identifying eligible R&D activities to preparing and submitting claims. We stay up-to-date with the latest HMRC guidelines, including the recent emphasis on adopting an in-year approach, to maximise your claim’s success. Additionally, we offer tailored advice and strategic planning to optimise your R&D investments, ensuring you receive the full benefits of available tax incentives. Let FI Group be your trusted partner in achieving R&D tax compliance and maximising your innovation potential.

In a significant move to accelerate the adoption of cutting-edge technologies, the UK government has launched the Regulatory Innovation Office (RIO). This new unit aims to reduce bureaucratic hurdles and speed up public access to transformative technologies, from AI in healthcare to emergency delivery drones.

The RIO is designed to streamline the regulatory process, making it easier for businesses to bring innovative products and services to market. By reducing red tape, the office will help fast-track approvals and ensure that different regulatory bodies work together efficiently.

Key Objectives

Initially, the RIO will focus on four key areas of technology that are rapidly evolving and have the potential to make a substantial impact on people’s lives. These areas include:

Engineering biology involves the use of synthetic biology and biotechnology to create innovative products and services derived from organic sources. These technologies have the potential to revolutionise health with new treatments, such as innovative vaccines and contribute to environmental sustainability by creating cleaner fuels. Additionally, they can make food production more efficient and sustainable through advancements like pest-resistant crops and cultivated meat. The new Regulatory Innovation Office (RIO) will play a crucial role in helping regulators bring these products to market safely and more quickly, thereby realising the significant environmental and health benefits they offer.

The UK’s space industry is experiencing rapid growth, supporting a wide range of applications from GPS on phones to vital communication systems. New innovations are enhancing weather forecasting and disaster response systems. To sustain this growth, regulatory reform is essential for providing greater agility and clarity. Such reforms will foster competition, encourage investment and open up market access, ensuring the continued expansion and success of the space sector.

With increasing pressures on the NHS, AI is poised to revolutionise healthcare delivery. AI technologies can help doctors diagnose illnesses faster and improve patient care. They also enhance hospital efficiency by reducing the administrative burden on medical staff, thereby cutting waiting times. Furthermore, AI enables the development of more personalised medicines, tailoring treatments to individual patients. The RIO will support the healthcare sector in deploying AI innovations safely, ultimately improving NHS efficiency and patient health outcomes.

Autonomous vehicles, such as drones, have the capability to deliver emergency supplies to remote areas quickly and efficiently. Approving and supporting this technology can significantly aid emergency services in keeping people safe. Additionally, greater support for autonomous technology could enable more widespread use of drones by businesses across the UK. This builds on successful projects like the Royal Mail’s drone service to Orkney, enhancing efficiency and service delivery.

As the office grows, it will expand its support to additional sectors, ensuring that the UK remains at the forefront of technological innovation.

The RIO will work closely with industry leaders, academic institutions and other stakeholders to continuously refine and improve the regulatory landscape. This collaborative approach ensures that the regulatory frameworks remain relevant and effective in the face of rapid technological advancements. Regular feedback loops and consultations will be established to address emerging challenges and opportunities, fostering a culture of continuous improvement.

UK innovators are developing world-leading technology, but a barrier to commercial exploitation and private capital is managing the red tape. Regulations, while serving an important role, currently delays approvals for new products and services. For instance, the MHRA recently had a backlog of almost 1000 clinical trial applications earlier this year. This means patients are missing out on new life-saving medical treatments. RIO will accelerate the commercialisation process, while unlocking economic growth for the UK economy.

Fawzi Abou-Chahine – Grants Funding Director

With the Labour government committing to make the UK an attractive space for innovation investment we will be here to assist you understanding the full landscape of tax incentives and grants available to your industry. Contact us today to unlock your businesses full potential and drive your innovations forward.

As an R&D advisor, I’ve encountered numerous CFOs and CEOs who assume their R&D tax claim process is fool-proof. Due to recent HMRC policy changes, combined with an increase in compliance checks, this assumption can have negative impacts to cashflow. Some rely on past experiences with different versions of HMRC, while others trust in their advanced technology. However, HMRC’s recent findings reveal that 36% of SME claims contain errors in their random enquiry program (MREP Results). Whether we agree or not, the House of Commons estimates that approximately 20% of claims undergo scrutiny, regardless of industry.

Let’s delve into the cash flow impact and broader consequences for companies, using the example of a loss-making tech SME that raises capital from external investors:

When these factors converge, the real-world consequences become evident in:

As an advisor, I’m frustrated by CEOs and CFOs who prioritise cost over quality consultancy. While most areas of the workforce are time poor, the ROI of proper filing is indisputable. If you have questions about avoiding compliance checks, feel free to reach out to FI Group.

Over the last 3 years, the UK has experienced an emergence of R&D tax platforms. These platforms are designed to reduce consultancy fees whilst maintaining a level of security, all with specialists and R&D tax consultants reviewing the technical report and costs.

Additionally, the R&D platforms currently on the market allow accountants to automate significant parts of their process, making R&D tax more accessible to their client base. However, with 50% of existing claims falling under a £30,000 benefit, the utility of these platforms may be limited in that they prioritise the simplification of reporting. This primary focus may exclude clients from maximising their financial returns.

While automation of this calibre can provide significant value, large parts of the necessary project qualification and technical writing then falls upon client shoulders. While the integrated user experience allows for information reporting immediacy, it neglects to account for increasing HMRC scrutiny around R&D tax, potentially pausing SME payments as a result. By outsourcing technical writing to R&D tax consultants who specialise in HMRC policy, it is possible to ensure maximum returns while simultaneously accounting for shifts in policy.

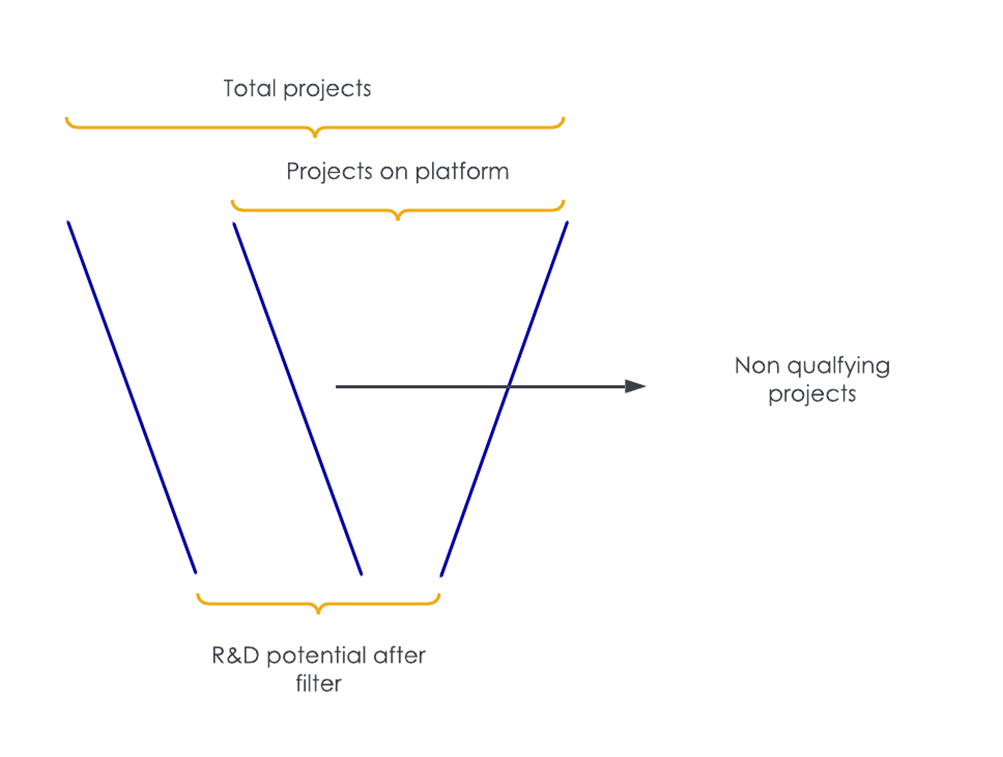

When it comes to the suite of services offered by R&D tax providers, one primary element of ensuring funding is to properly filter out non-qualifying projects. When accounting for the accuracy of R&D tax platforms, filing entities must evaluate the aptitude of these platforms to act as sufficient filtering systems. Diligence in filing is essential, but diligence in determining project eligibility is a foundational aspect of R&D success. The graphic below is designed to show impact to claim size when filtering with platforms.

While systematically integrating technology and automated programs into R&D tax processes is an inevitability of industry progress, we must ensure that the bulk of workload is not then forced onto the client as a result of necessitating in-house data input. With consistent changes to HMRC policy, ensuring the continued use of consultancy is important when evaluating the value of reports, project success, and secured funding potential.

Time sheeting has three primary advantages in regards to claiming R&D. The first is security. HMRC, in their 2020 tribunal win against Hadee Engineering, cited that timesheet data is the ‘gold standard’ for calculating R&D percentages of staff.

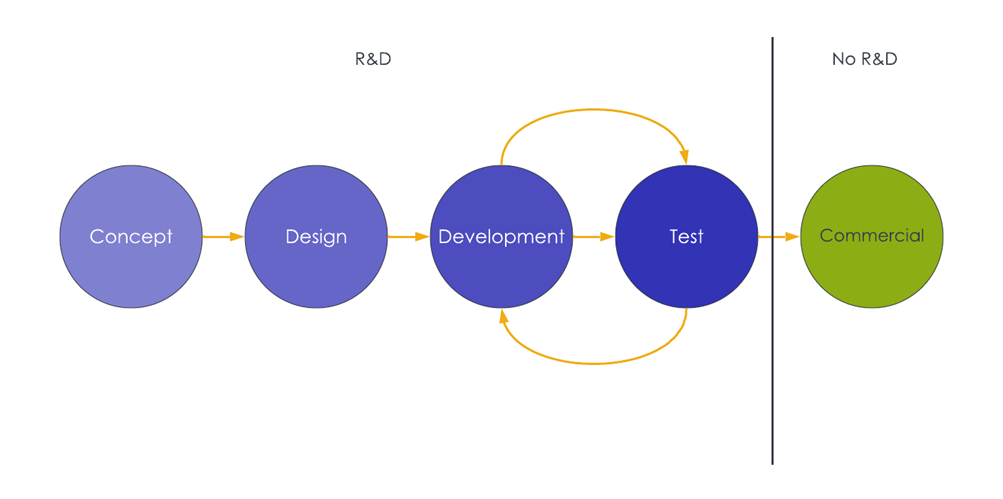

This level of security goes further when the timesheet data is broken down into clearly identifiable stages within the course of a project. This then means that percentages of R&D time sheeting can be allocated as stage-dependant. For example, in a R&D project, you can typically break down the stages.

With this level of detail, you can more accurately calculate R&D at each individual stage. This data contribution provides maximised levels of security in calculating staff costs. Should an enquiry be raised by HMRC, this methodology will stand up to any inspector.

Having data readily available at each of these stages allow claims to be safely increased. Many companies neglect to track data throughout the concept stage, resulting in excluded time.

Claimants often qualify their projects at the end of the year or as their projects occur. By utilising timesheet software, claimants may be able to quickly identify projects for further discussion.

This practice removes manual excel exercises, and in some instances, meetings with providers to discuss the boundaries of R&D tax. As a result, timesheets can increase claim size, increase security, and save time.

This element of R&D, claim progress reporting, is the one area where R&D platforms have a jump on the more traditional specialists. While the client shouldn’t be qualifying projects or conducting technical writings, a shared portal where the client can see the technical report as it is created is a time-saver that avoids trite back-and-forth occurances via email.

The real value in claim progress reporting is the element of control, coupled with the ability to forecast elements of the claim. Claim progress reporting can quickly identify blockers to information gathering.

It can also allow a common portal for provider and claimant to see the claim evolve, allowing the claimant to forecast claim size. Better foresight on claim size can allow for multiple benefits:

– Delay in fundraising

– Less dilution of shares

– Speed-up in hiring

– Ability to participate in debt financing

– Facilitation of investment into CAPEX

With the introduction of the new merged R&D scheme, the ability to demonstrate who ‘owns’ the R&D has become more important. One method is to track all pre-contractual client conversations and consolidate the contract in one place. Because HMRC continuously increases the necessary tracking components, policy literacy is an ever-moving landscape. This is software can help by having a single location to upload data solely for R&D tax purposes. By proxy, this can create a place for the client and advisor to ensure required documents are easily accessible. This can be achieved through internal systems, but the limitation continues to be advisor access.

In summary, software should be utilised in R&D tax claims not to remove the human element of consultancy, but to increase immediacy in which clients can check the progress, existing data, and expediency of their claim. With the changes happening with HMRC legislation that require more structural consultancy, software should serve as support of the human element necessary for R&D filing.

Claiming R&D tax benefits within the manufacturing sector can lead to common questions on behalf of the filing entity. As a process guide, FI Group will walk through the relevant qualifications, highlight the key benefits of investing in innovation, and describe the claiming process for potential beneficiaries.

Research and Development (R&D) refers to the activities companies undertake to drive innovation that can improve their products, processes, and overall business performance. Further, R&D Investments can be defined as supporting activities where the baseline of science or technology is advanced through the resolution of scientific or technological uncertainty that was not easily foreseeable by a competent professional in that field.

When it comes to the manufacturing sector specifically, R&D efforts are focused on developing new technologies and techniques that improve the productivity, quality, and environmental impact of their production processes.

In general, there are 4 specific focus areas of R&D in manufacturing. Let’s review them one by one.

This area of R&D in manufacturing is all about improving the actual processes used to make individual products. Manufacturers may invest in R&D to develop new processing and handling methods that boost the efficiency and consistency of their operations.

For example, a company might research and test new and more effective techniques for cutting, assembling, or finishing their products in a way that reduces waste, improves quality, and lowers costs. Or they may explore the use of new, more environmentally-sustainable materials that perform better than what they’ve used in the past.

The key goals of R&D at the per unit processing level are to find ways to make each unit or product better, faster, and more cost-effective to manufacture. This helps manufacturers stay competitive by delivering higher-quality goods at lower prices.

A major focus of R&D in manufacturing is improving the equipment and machinery used on the factory floor. Manufacturers invest heavily in developing new, more advanced production machines as well as upgrading their existing equipment. They are doing this in order to improve the throughput and make the manufacturing process more affordable. For example, this could involve creating specialised robots, implementing sophisticated computer controls, or redesigning key machine components.

Upgrading equipment through R&D helps companies boost productivity, meet customer demands, and maintain their competitive edge.

This machine-focused R&D is especially crucial as manufacturers adopt Industry 4.0 technologies.

R&D in manufacturing also encompasses the broader systems and infrastructure that enable the production process. Rather than focusing on individual machines, this area of research and development looks at advancing the interconnected controls, sensors, and communication networks that underpin the entire manufacturing operation.

The goal of systems-level R&D is to create more integrated, responsive, and efficient production environments. Manufacturers invest in developing new technologies that can better monitor, coordinate, and optimise their entire manufacturing system.

This could involve innovating around the automated control systems that manage production lines, the sensor networks that provide real-time data, or the software platforms that integrate disparate systems. By improving the connectivity and intelligence of these wider systems, companies can drive significant gains in productivity, flexibility, and quality.

For example, R&D into advanced manufacturing execution systems (MES) allows businesses to centrally manage and monitor the production process. Sensor-based technologies that track machine performance and environmental conditions are another area of systems-focused R&D, providing valuable insights to improve operations.

The final focus area of R&D in manufacturing is – societal or environmental level technologies. This aspect of innovation is concerned with developing solutions that promote the competitiveness and sustainability of the industry as a whole.

Whereas the other R&D focus areas centre on improving the core manufacturing processes and equipment, this domain looks outward at supporting the workforce and addressing broader environmental challenges.

One major area of societal-level R&D is enhancing the health, safety, and ergonomics of manufacturing environments. Manufacturers invest in researching new technologies and methods that can better protect their employees and improve working conditions in the factory.

This might involve developing specialised tools or machinery that reduce physical strain, or exploring AR solutions that provide real-time guidance to workers. The goal is to create a safer, more comfortable work experience that also boosts productivity.

The scope of eligible R&D in manufacturing is broad, but here is what projects it covers: